Zurich Global Screened funds

Values-based investing made simple

The Zurich Global Screened Investment Solution invests in funds that promote Environmental, Social and Governance characteristics by avoiding or increasing exposure to certain companies, sectors or business practices. This ensures that we can focus on funds that fit the values of our solution.

Designed together with HSBC Global Asset Management, one of the most dedicated asset managers in the Sustainable and Responsible Investment landscape, the Zurich Global Screened funds offer a range of low-cost risk-rated profiles designed to meet investors’ values or ethical preference.

Feel good about choosing an investment solution that aligns your values with your money to help you achieve your financial goals and see less harm in the world.

Global diversification

Gain global asset allocation with a broad exposure across key markets and different asset classes.

Values-based investing

Choose an approach that reflects your values by trusting the solution to avoid or increase exposure to specific companies, sectors or business practices.

Cost

Benefit from a low-cost investment solution, thanks to index tracking funds.

Experience

Independently managed by HSBC Global Asset Management - one of the most recognised names in the Sustainable and Responsible investments landscape.

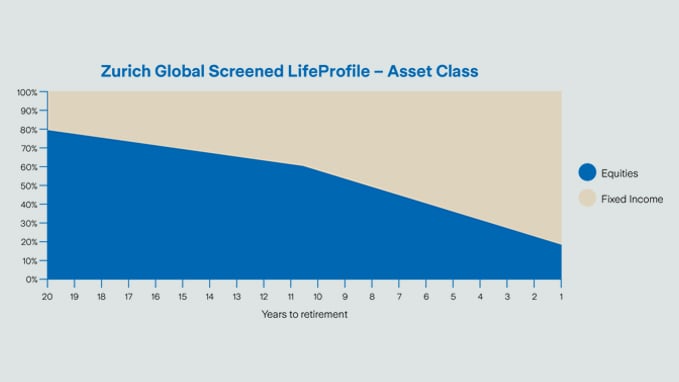

Risk profiles

Each fund offers access to a different allocation towards equities and bonds aligned with a range of investor profiles, from the lower risk / lower return Zurich Global Screened 20% Equity Fund, through to the higher risk / higher return Zurich 100% Equity Fund. Available in three currencies: US dollar (USD), Euro (EUR) and Sterling (GBP).

Equity Bonds

Zurich Global Screened

20% Equity Fund

Zurich Global Screened

40% Equity Fund

Zurich Global Screened

60% Equity Fund

Zurich Global Screened

80% Equity Fund

Zurich Global Screened

100% Equity Fund

Investment principles

Customers with strong values around issues such as protecting the environment, animal welfare or equality for everyone may not want their savings going to companies or sectors that have business practices that they don’t agree with. Values-based investments offer reassurance and enable them to address those relevant issues.

Studies have shown that sustainable investments generally perform better than similar funds or indices that aren’t focused on ESG factors.

However, investors should be prepared to accept that values-based investments perform differently than conventional funds due to the low exposure or avoidance to certain sectors.

Find out more about Zurich Global Screened funds and HSBC